Most Merchants Unlikely to Surcharge Credit Card Sales

Most merchants will likely take a wait and see approach before contemplating adding surcharges, letting their closest competitors try it first.

Another issue is that new application software to support surcharges has not yet been widely developed. One of the many stipulations if a merchant chooses to implement surcharge fees is that they must use a payment application which supports the following mandated POS … more

Like his previous article discussing the merchant services industry, Michael Conticelli has done it again with a must read insightful report in the Ft. Myers Small Business Examiner titled “New trend in merchant statements hides rates and fees”.

Like his previous article discussing the merchant services industry, Michael Conticelli has done it again with a must read insightful report in the Ft. Myers Small Business Examiner titled “New trend in merchant statements hides rates and fees”.

It’s what all merchants are looking for; who doesn't want the “best merchant rates”? The real question for merchants is how to go about achieving this while avoiding the pitfalls of selecting a poor service provider.

It’s what all merchants are looking for; who doesn't want the “best merchant rates”? The real question for merchants is how to go about achieving this while avoiding the pitfalls of selecting a poor service provider.

As we head into the start of a new year, now is a good time to review your card processing procedures. Many of the highest Interchange rates result from transactions that downgrade for preventable reasons. Please take a moment to review your card acceptance procedures and follow best practices as they are important in qualifying your transactions at the very lowest Interchange rates available.

As we head into the start of a new year, now is a good time to review your card processing procedures. Many of the highest Interchange rates result from transactions that downgrade for preventable reasons. Please take a moment to review your card acceptance procedures and follow best practices as they are important in qualifying your transactions at the very lowest Interchange rates available.

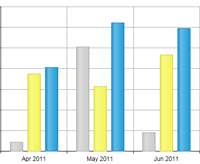

Merchant statements soon to reveal who gets savings from lower debit Interchange.

Merchant statements soon to reveal who gets savings from lower debit Interchange.