Smarter Taxes

With tax day almost here, it seems appropriate to consider what the federal tax system is costing taxpayers in addition to the taxes themselves.

- Complying with the federal income tax code amounts to imposing a 22.2-cent tax-compliance surcharge for every dollar the income tax system collects.

- Corporations with assets of $1 million or less (more than 90 percent of all corporations) paid a minimum of $382 in compliance costs for every $100 they paid in income taxes.

- A compliance burden of 6 billion hours per year represents a work force of over 2,884,000 people: Larger than the populations of Dallas (1,210,393), Detroit (900,198) and Washington, D.C. (553,523) combined; and more people than work in the auto, computer manufacturing, airline manufacturing and steel industries combined.

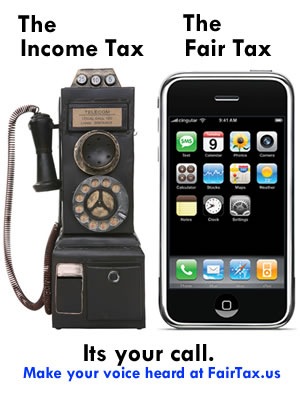

To be competitive in the next century and to renew the American dream, we must change the way we fund our federal government by implementing a smarter tax collection system. Regardless of whether you believe taxes are too high or low, it’s clear that our current income tax system is antiquated, corrupt, expensive and wasteful.

A recent USA TODAY article titled "Tax code grows like kudzu as another April 15 approaches" points out that "The instruction booklet that comes with Apple's new iPad is one page. The instruction booklet that comes with this year's IRS 1040 long form is 172 pages." The tax code has grown so complex that even the IRS commissioner doesn't prepare his own taxes.

Why is the tax code so complex? Career politicians are to blame, Rs and Ds alike, as they manipulate the tax code, providing tax preferences as their main instrument of power and influence and rewarding special interests to get re-elected again and again. Spending our tax dollars on earmarks are another way in which members of congress reward their campaign donors. And as the government sector grows, lobbyists are enjoying record revenues according to a recent report. Tax reform is not only about providing badly needed economic stimulus (both long and short term), but also about reforming the system of earmarks and tax preferences in exchange for campaign cash, facilitated by a growing army of lobbyists/influence peddlers.

A new and improved approach is needed to replace the tangled web of nearly 10,000 exemptions, deductions, credits and other preferences that currently clutter the U.S. tax code in order to create a simpler and fairer system that American workers and businesses can more easily navigate. By eliminating many of the tax expenditures that benefit narrow special interests, tax reform offers fiscally responsible tax-relief to the middle class and growth opportunities for American businesses to create jobs and compete globally.

I’m an entrepreneur for tax reform. And I’ve become an advocate for the FairTax plan after reading the books, studying the research, carefully listening to the arguments for and against both the status quo and other proposals. The FairTax plan follows these eight guiding principles:

-

Fair: It must protect the poor and treat everyone else the same. No exemptions - no exclusions - no advantages.

-

Simple: It must be easy to understand for all Americans - no matter one's education, occupation, or station in life.

-

Voluntary: It must not be coercive or intrusive.

-

Transparent: We should all know what the government costs. There must be no "hidden" taxes.

-

Border Neutral: Our exports must be unburdened by any tax component in the price system, while imports carry the same tax burden at retail as our domestic competition. Corporate income taxes, payroll taxes and their associated tax compliance cost and avoidance fees are embedded in the prices of every domestically produced good and service we buy and export. Why should our citizens and exports be burdened by higher prices simply due to our tax system?

-

Industry Neutral: It must be neutral between businesses and industries.

-

Strengthens Social Security: Broadening the tax base with a national retail sales tax means that millions and millions of foreign visitors (both legal and illegal), who currently don’t pay income or payroll taxes, will contribute by paying taxes on their spending.

-

Manageable Transition Costs: It must not be costly or difficult to implement.

Lets move away from the “tax the rich” answer to all our problems. That worn out solution only goes so far. AP recently reported that "Nearly half of US households escape fed income tax". We are quickly moving in an unsustainable direction with "a tax system that exempts almost half the country from paying for programs that benefit everyone, including national defense, public safety, infrastructure and education."

There is a more intelligent way to fund our government. There are only two things for "rich people" to do with their money – one is to spend it and the other is to save it. If we tax on spending, when they spend it - they pay tax. If they save it, there is more money and capital to loan to entrepreneurs to build innovative companies and bring innovative products to market, fueling jobs that pay higher wages, leading to more spending and to higher tax revenue.

And it’s a better plan for the poor than having to “file” to get a tax credit. The poor can benefit greatly under the FairTax plan:

1) by increasing purchasing power through more take home pay (they get 100% of their earnings with no payroll deductions and a prebate payment at the beginning of every month to pay for the taxes on purchases up to the poverty line) and buying cheaper goods that don’t carry embedded tax and tax compliance costs.

2) from a rapidly growing economy due to more US jobs (since our products will be more competitive on the world market) and with greater investment in new US based businesses developing innovative technology breakthroughs that can deliver cheaper, cleaner energy, medical advances, healthier food, etc. that raise all citizens standard of living.

Given the increasing global competition from China, India, and the rest of world, we must innovate to stay ahead and this innovation must start with replacing our corrupt tax code.

I hope you will join our business in becoming involved in your own way. An easy first step is to become listed in the FairTax business directory at http://fairtax.us. Then join the grassroots effort to elect candidates that will pass the FairTax legislation already in the house and senate.