Happy New Year!

As we head into 2012 we want to once again take this opportunity to Thank You for choosing Vantage.

As we head into 2012 we want to once again take this opportunity to Thank You for choosing Vantage.

This year we blogged about some of the most pressing issues in the payments industry impacting merchants accepting card payments. 2011 saw major industry changes enacted, including new PCI security, IRS reporting, and the Durbin Debit regulations.

Thank you again for the privilege of being your payment solutions partner and for the opportunity to earn your trust, loyalty, and business every day. It is very exciting to be able to work with so many great entrepreneurs! We would like to extend a special thank you and our sincere gratitude for all your referrals and testimonials. We pledge to continue to build upon and maintain the Vantage reputation for the high level of personal service you … more

As we head into the start of a new year, now is a good time to review your card processing procedures. Many of the highest Interchange rates result from transactions that downgrade for preventable reasons. Please take a moment to review your card acceptance procedures and follow best practices as they are important in qualifying your transactions at the very lowest Interchange rates available.

As we head into the start of a new year, now is a good time to review your card processing procedures. Many of the highest Interchange rates result from transactions that downgrade for preventable reasons. Please take a moment to review your card acceptance procedures and follow best practices as they are important in qualifying your transactions at the very lowest Interchange rates available.

In the news this week were several stories about small business lending. In “Bank loans to small business fall to 12-year low” an analysis of FDIC data showed that the number of small loans to business of $1 million or less have been shrinking consistently.

In the news this week were several stories about small business lending. In “Bank loans to small business fall to 12-year low” an analysis of FDIC data showed that the number of small loans to business of $1 million or less have been shrinking consistently.

Congratulations to Vantage clients Moss Mills and Pure Fiber on their recent appearances on NBC’s Today Show as featured in Jill’s Steals and Deals. The Today Show segment "Steals and Deals" airs every other Tuesday morning to millions of viewers. Needless to say, both events were very successful and resulted in a huge surge in sales volume.

Congratulations to Vantage clients Moss Mills and Pure Fiber on their recent appearances on NBC’s Today Show as featured in Jill’s Steals and Deals. The Today Show segment "Steals and Deals" airs every other Tuesday morning to millions of viewers. Needless to say, both events were very successful and resulted in a huge surge in sales volume.

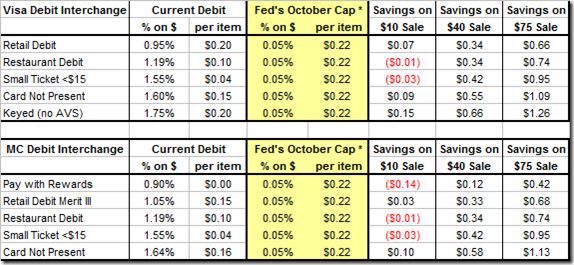

Merchant statements soon to reveal who gets savings from lower debit Interchange.

Merchant statements soon to reveal who gets savings from lower debit Interchange.

Small business owners are a new favorite target for hackers hoping to take advantage of weak security in small business environments. This excerpt from a recent article in the Wall Street Journal article Hackers Shift Attacks to Small Firms sums up the new reality:

Small business owners are a new favorite target for hackers hoping to take advantage of weak security in small business environments. This excerpt from a recent article in the Wall Street Journal article Hackers Shift Attacks to Small Firms sums up the new reality:

The countdown to lower debit Interchange is on with only 11 short weeks remaining. The most important thing merchants can do now is switch to an Interchange plus pricing plan. Take a look at your current merchant statement. If you have a “qualified” rate or “non-qualified” transaction fees its time to act. No matter the size of your business or the industry you are in, it's easy to start processing on an Interchange pass through pricing plan by visiting MerchantRates.com.

The countdown to lower debit Interchange is on with only 11 short weeks remaining. The most important thing merchants can do now is switch to an Interchange plus pricing plan. Take a look at your current merchant statement. If you have a “qualified” rate or “non-qualified” transaction fees its time to act. No matter the size of your business or the industry you are in, it's easy to start processing on an Interchange pass through pricing plan by visiting MerchantRates.com.

Today businesses are finding that accepting card payments is a growing necessity and often a preferred method for collecting accounts receivables. So when Bill.com, who helps small and mid-sized businesses efficiently manage their day-to-day bill payment and invoicing processes, looked to integrate credit and debit card acceptance they conducted extensive research.

Today businesses are finding that accepting card payments is a growing necessity and often a preferred method for collecting accounts receivables. So when Bill.com, who helps small and mid-sized businesses efficiently manage their day-to-day bill payment and invoicing processes, looked to integrate credit and debit card acceptance they conducted extensive research.

MerchantRates.com, a service of Vantage Card Services, was originally launched in December of 2000. For over 10 years now, MerchantRates.com has been providing instant merchant Interchange rate quotes!

MerchantRates.com, a service of Vantage Card Services, was originally launched in December of 2000. For over 10 years now, MerchantRates.com has been providing instant merchant Interchange rate quotes!