MerchantRates.com Helps Small Business with Interchange Pricing

MerchantRates.com, a service of Vantage Card Services, was originally launched in December of 2000. For over 10 years now, MerchantRates.com has been providing instant merchant Interchange rate quotes!

MerchantRates.com, a service of Vantage Card Services, was originally launched in December of 2000. For over 10 years now, MerchantRates.com has been providing instant merchant Interchange rate quotes!

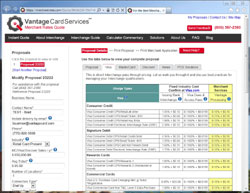

MerchantRates.com’s latest release is faster and more secure than ever. The user experience has been enhanced with updated content, new solutions, better organized Interchange rates by industry and the ability to easily generate and compare multiple proposals. MerchantRates.com is an award-winning small business site featuring:

- On Demand Quote and Proposal in under a minute

- Customized for your business

- Results Delivered Real-Time

- Industry specific Interchange Rate & Fee Schedule

- Ready to Sign Application

- Read complete Month-to-Month Terms

- No Hidden Fees

- Monitor your Costs - return anytime for a new quote

- Payment Analysts Ready to Help

Of course with a focus on merchant Interchange rates, we’ve been closely following the Fed proposal to set a price cap on debit card Interchange fees under new powers from the Dodd-Frank Financial Reform Act. While the final Interchange regulation on debit is not official, and the debate continues, the deadline fast approaches and it is very important for small merchants to act now to position themselves appropriately.

The first thing to understand is that any reduction in debit Interchange doesn’t necessarily mean small merchants will realize these savings. The reality is the majority of small merchants are priced on a tiered pricing structure (the "as low as" qualified rate, a mid-qualified rate and a non-qualified rate). Other small merchants are paying a variety of other pricing plans (flat, surcharge, enhanced, etc.) all “invented” by a service provider.

In the industry trade journals the talk is that while the Interchange may be reduced by 80%, that it is estimated that only a quarter to a half of the savings will actually be passed on to small merchants. And since most small merchants on tiered pricing plans also don't bother to read the fine print, they are locked into long-term contracts with early termination fees, so there is no reason for providers to immediately pass all the savings through.

So the big question for small merchants is how much of the savings will actually be passed on to them? Like the very largest merchants, unless small businesses begin to insist on a direct Interchange pass-through billing plan like the one offered on MerchantRates.com the odds are they may not see any benefit from this legislation.

Further complicating the small business merchant rate story is another issue that we've raised while following the debate. The majority of small merchants are also in communities where the majority of their customers will be using debit cards issued by exempt community banks and credit unions. As it stands now, Visa does plan to support two debit-Interchange levels - an artificially low Interchange rate set by the government for cards issued by mega-banks while leaving the existing higher debit Interchange rates in place for debit cards issued by community banks and credit unions. The result is that small merchants will be further disadvantaged with higher costs versus large merchants operating in markets primarily served by mega-banks.

And one last point. Not all merchant Interchange rate quotes are the same. Some Interchange quotes charge a "simplified" fee of $45/month to small merchants in order to get their Interchange pricing. Other providers continue with their old tricks, using a tiered pricing mark up over Interchange. In an example of this type of Interchange pricing scheme you would find Interchange plus 20 basis points for a “qualified” transaction, yet charging 50 basis points over Interchange for a mid-qualified transaction and 100 basis points over Interchange for anything they consider a non-qualified transaction.

There is no obligation to generate a free instant merchant Interchange rate quote on MerchantRates.com. We encourage all small businesses to at the very least use the site and quote calculator to begin to familiarize themselves with the concept of Interchange pass-through and why it is important. We also hope that our message of reading the fine print and only signing a month-to-month agreement is also adopted. If all merchants did this it would change the merchant services industry for the better.