Don’t Let Your Bank Hide Fees

Like his previous article discussing the merchant services industry, Michael Conticelli has done it again with a must read insightful report in the Ft. Myers Small Business Examiner titled “New trend in merchant statements hides rates and fees”.

Like his previous article discussing the merchant services industry, Michael Conticelli has done it again with a must read insightful report in the Ft. Myers Small Business Examiner titled “New trend in merchant statements hides rates and fees”.

Michael specifically calls out SunTrust for purposely redesigning their merchant statements to eliminate all rate and fee detail, leaving merchants no clue as to how charges are calculated. SunTrust made the decision to keep merchants in the dark about their “surcharge fees, bill backs, annual fees, PCI fees, etc.” because when merchants “don’t actually see the rates and fees month after month” they can’t ask questions.

Michael warns “Merchants need to be vigilant in monitoring their merchant fees.”

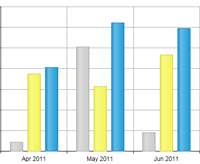

We couldn’t agree more! In fact, Vantage Card Services takes the exact opposite approach with our clients. Not only do we provide a very detailed merchant statement, we also provide our PayView analytics tool to help merchants explore stats and trends, chart their sales, manage their Interchange qualifications and track their effective "real rate" calculations month after month.

PayView is a user-friendly dashboard and analytics reporting tool that merchants can use to gain greater insight and more transparency into the cost of accepting card payments. This added layer of business intelligence empowers our clients with a greater understanding of where fees come from, best practices to keep costs down and a historic tracking of processing expenses.

Read more and take a tour at http://vantagecardservices.com/payview.